You are now leaving www.sealynet.com

Please confirm your departure

Capabilities

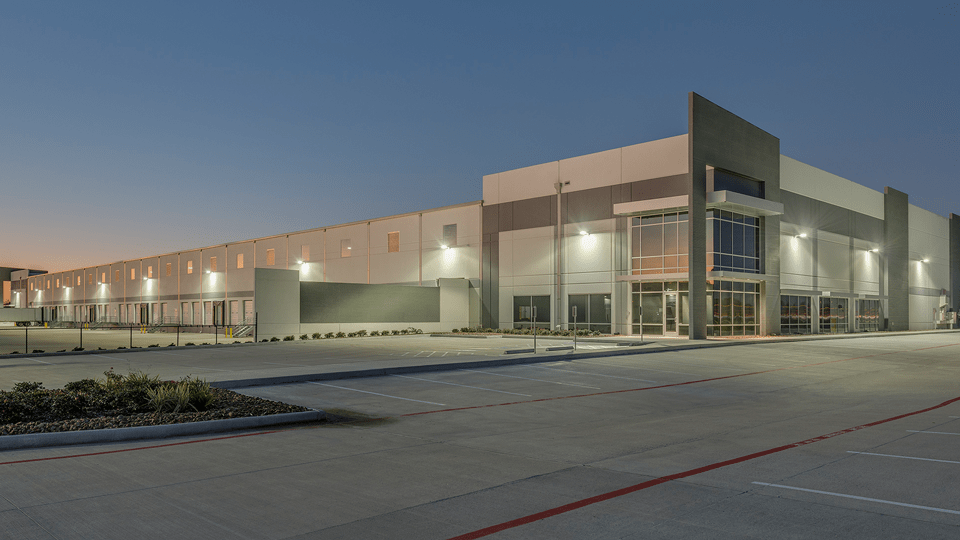

A Full-Service Commercial Real Estate Platform

Sealy & Company’s real estate capabilities include; investment, acquisition, development, asset/property management, construction management, marketing, leasing, and more.