Sealy & Company has dedicated over 75 years to the focused ownership, redevelopment, and operation of single and multi-tenant industrial buildings catering to the demands of tenants requiring industrial spaces of 25,000 square feet to 250,000 square feet. With a diverse portfolio currently exceeding $3 billion in assets, our strategic approach has always been to identify and leverage market inefficiencies, particularly in this underserved segment. Our depth of knowledge, product understanding, and proven track record of delivering results in this market niche set us apart as a market leader. Our commitment to following our proven investment thesis empowers us to adeptly meet the evolving needs of the market and our tenants, allowing us to navigate the complexities of the industrial real estate market with unparalleled expertise.

In our review of a recent article by (CoStar) “Available Space for Smaller Industrial Properties Remains Near Record Low” on the current state of the industrial real estate market, we find that the challenges and opportunities it outlines resonate with our long-standing strategic focus. CoStar’s analysis brings to light the ongoing shortage of industrial spaces suited for small, blue-collar businesses—which remains unmitigated by the recent surge in industrial construction.

![]()

A shortage of industrial space available to small, blue-collar businesses has prevailed across most of the United States for more than five years, and the industrial building boom that started during the pandemic has done little to remedy the situation.

The space crunch smaller industrial tenants face in 2024 is mostly driven by supply-side economics. The process of purchasing and entitling a land parcel large enough to build an industrial building the size of a McDonald’s is often almost as time-consuming as acquiring and entitling a 40-acre parcel that can accommodate an industrial development the size of multiple football fields.

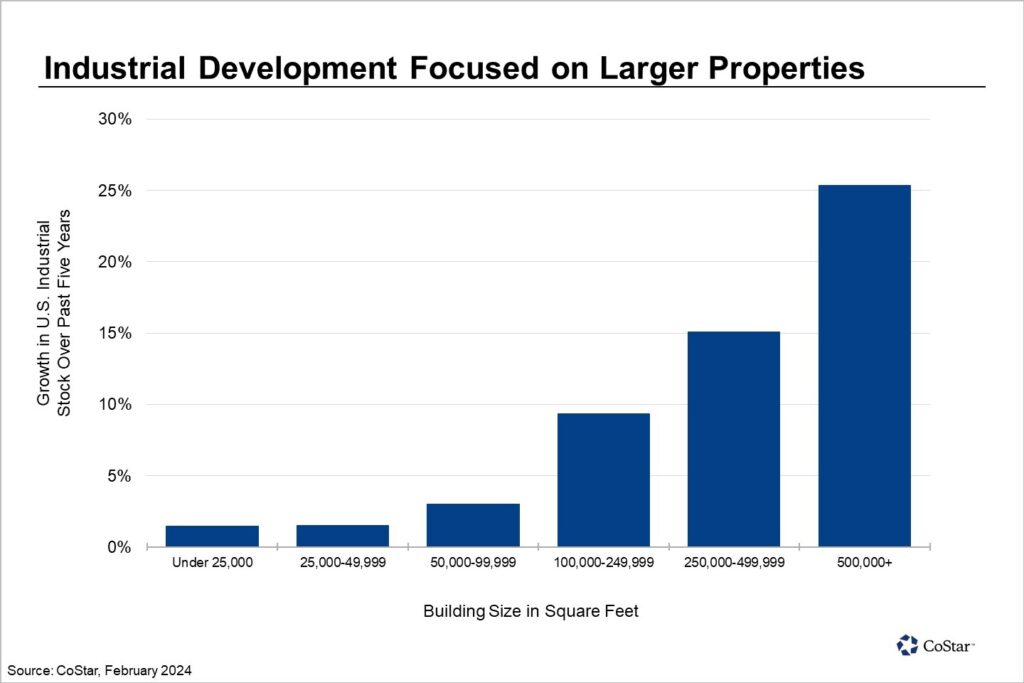

Faced with these market dynamics and looking to make the most efficient use of their employee’s time and their investors’ dollars, industrial developers tend to focus on building giant distribution centers and manufacturing facilities that can secure long-term leases from multinational businesses.

Meanwhile, fewer developers build properties that accommodate smaller tenants. For example, industrial properties smaller than 25,000 square feet, about half the size of an American football field, comprise 29% of existing U.S. industrial space, but less than 2% of the industrial space under construction in 2024.

Demolitions of smaller industrial properties to make way for residential development in urban areas have also limited the space available to small tenants as most industrial developers have focused on building projects that are 100,000 square feet or larger.

As a result, the stock of industrial properties measuring smaller than 100,000 square feet has only grown by about 2% cumulatively over the past five years, while growth in the stock of industrial properties sized 100,000 square feet or larger has grown eight times as quickly, by about 16%.

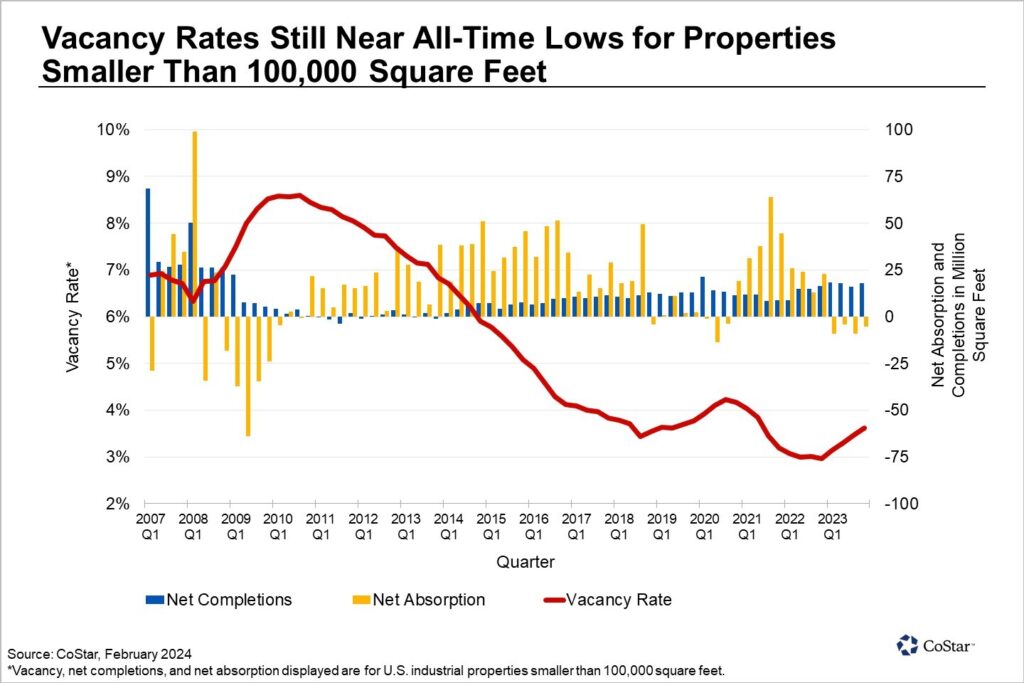

Smaller industrial tenants, including those in the building trades, small manufacturing or logistics, haven’t been immune to economic pressures from inflation and higher interest rates. Absorption, the change in occupied space, was slightly negative for U.S. properties smaller than 100,000 square feet in 2023, a noticeable slowdown from booming leasing levels that occurred mid-pandemic. But with few small industrial developments being built, the national vacancy rate for these properties remains below 4% and near the lowest levels ever recorded before the pandemic.

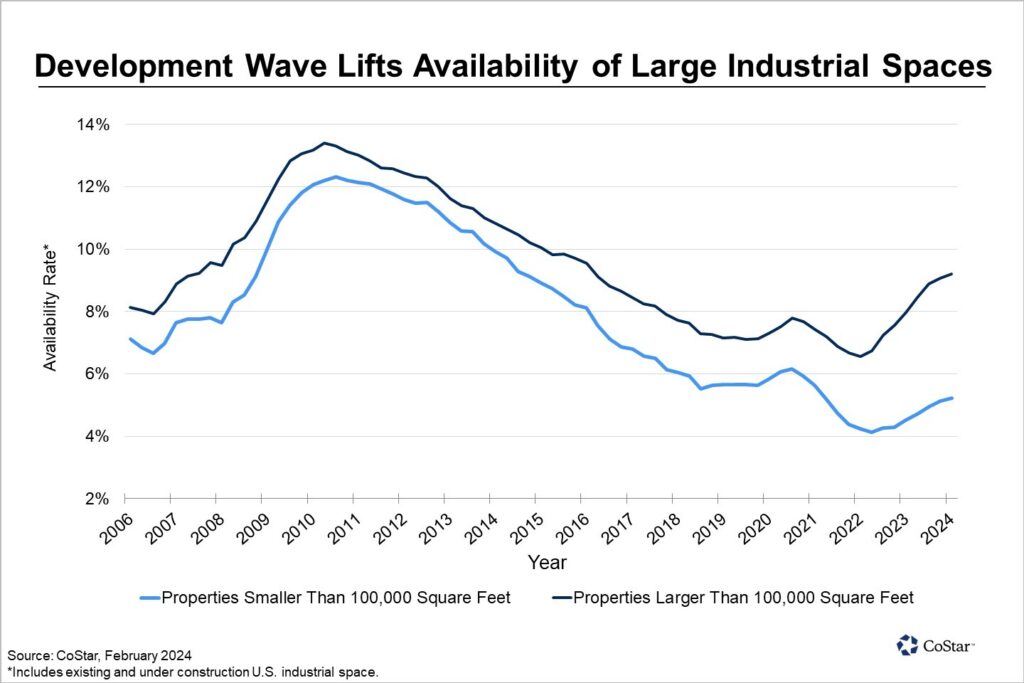

At 5.2%, the portion of U.S. industrial space listed as available for lease in properties smaller than 100,000 square feet has also risen in recent months but remains near pre-pandemic record lows.

This contrasts with availability rates for properties 100,000 square feet or larger, which have risen back up to 2016 levels as the market contends with record completions of unleased big-box distribution center developments. The gap in availability rates between these two segments of industrial properties is currently the widest CoStar has ever recorded.

In most markets, near-record low availability rates should position small and mid-size industrial properties for stronger rent growth than their larger counterparts over the next several quarters. Falling interest rates and recent improvements in consumer spending may soon even stimulate additional growth in industries such as construction and manufacturing and cause leasing by small tenants to pick up in many markets that already have minimal spaces available to meet these businesses’ needs.

For more news and information regarding Sealy & Company, please visit the company’s website at www.Sealynet.com.

About Sealy & Company

Sealy & Company, a fully-integrated commercial real estate investment, and operating company, is a recognized leader in acquiring, developing, and redeveloping regional distribution warehouse, industrial/flex, and other commercial properties. Sealy provides a full-service platform for high-net-worth individuals and institutional investors through our development, management, and brokerage divisions.Sealy & Company has an exceptional team of over 100 employees, located in five offices, with corporate offices in Dallas, TX and Shreveport, LA.